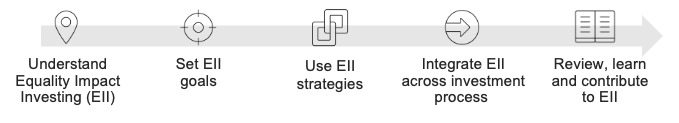

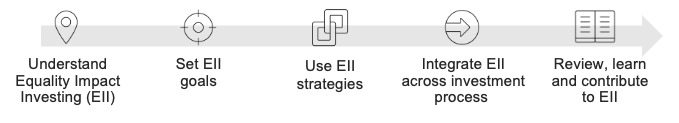

Use Equality Impact Investing Strategies

What are the strategies to deliver equality impact investing? How to choose among these strategies?

There are five broad types of equality impact investing (EII) strategies, which can be applied individually or simultaneously. Indeed, whilst we have set them out separately for ease of reference, the distinction between them is certainly not always clear-cut. They can be used simultaneously and can also be mutually reinforcing.

Click the icon of the section you’d like to go to

What are EII strategies

The first four EII strategies are external-facing strategies (focused on who and what you invest in), whereas the fifth strategy is internal-facing (focused on improving your own make up and practice).

+ Capital to marginalised entrepreneurs

Investment capital is channelled to entrepreneurs that face one or more forms of inequality or discrimination based on their individual characteristics and status. This strategy tackles inequalities such as underrepresentation of marginalised groups as entrepreneurs, an important and influential group in society, and also evidence of a “credit gap” for women and ethnic minority entrepreneurs attributed in part to discrimination.

See this example using this strategy

+ Target ventures with good equality and diversity practice

Investors focus on ensuring their investees are both optimising leadership and employee diversity (based on characteristics or statuses such as age, disability, gender, ethnicity, religion or belief and sexual orientation) in their organisational make-up, and also considering the equality impact of their wider operations, products and services.

This includes addressing the equality impact in their direct operational processes e.g. in recruitment and workforce related practice, marketing and communications, sales and distribution channels, procurement and their wider value chains (e.g. supplier workforce practices).

See this example using this strategy

+ Target inequality mitigating organisations

Inequality mitigating organisations or initiatives aim to either ensure minimum basic standards in how these people and groups are treated (the human rights “floor”; such as tackling extreme poverty) and/or seek to limit the effects of discrimination and inequality still further (raising the ceiling; such as building the confidence and resilience of marginalised groups to deal with additional barriers or challenges they may face in employment because of their status or characteristics). In general though, they do not focus on the wider causes or drivers of the discrimination or inequality they are seeking to mitigate.

See this example using this strategy

+ Target equality transformative organisations

Equality transformative organisations or initiatives seek to identify and/or address the root causes or structures of inequality, as well as develop alternatives, with a view to supporting long term transformative change.

See this example using this strategy

+ Improve investors own make up and practice

Investors consider the equality impacts of their own operational practices and diversity and take active steps in improving their equality impacts as an organisation and throughout their investment process.

See this example using this strategy

How to choose EII strategies

Equality impact investing (EII) strategies can be applied across the impact investment process, on the basis of EII premises and principles. To choose EII strategies, you should understand where you want to reduce inequality and/or advance equality - on yourselves, on a certain group of people, on society as a whole, etc. This will be informed when you conduct your inequality analysis, and then you can consider one or more strategies to achieve your goals. Consider these questions when choosing your strategies:

CASE EXAMPLE: A PLACE-BASED FUND IN BIRMINGHAM, UK

Following the same example in the goal-setting stage (a place-based fund in Birmingham, UK), the fund can pursue several EII strategies to advance its equality impact goals:

Capital to marginalised entrepreneurs: It can invest in organisations/ventures that are led by ethnic minority women.

Target ventures with good equality and diversity practice: It can invest in organisations/ ventures that employ high numbers of low-income ethnic minority women and that source their services from businesses led by ethnic minority women.

Target inequality mitigating/ equality transformative organisations: It can invest in organisations/ ventures with products and services that increase levels of quality employment among ethnic minority women (e.g., providing affordable and quality childcare, training and employer-matching schemes, monitoring systems for workplace practices, consultancy on recruitment processes, incubator for ethnic minority women led businesses).

Improve investors’ own make-up and practice: It can improve its staff’s representation by recruiting more ethnic minority women and integrating the lived experience of challenges faced by ethnic minority women into its investment processes.

TIPS AND TOOLS

The following diagram look in more detail at the questions you might consider to decide which of the EII strategy/ies you might adopt, but it is only illustrative as practices around EII are constantly evolving.

STEP 1: Identify fit with impact

It is important to first identify what the best fit would be to help you achieve your equality impact goals, thinking about questions along the three dimensions where inequality manifests: outcomes, processes and structures.

+ Case example: A place-based fund in Birmingham, UK

The place-based fund in Birmingham may decide that they’d like to focus on addressing the outcomes of ethnic minority women directly, as opposed to addressing other process and structural challenges (maybe because these challenges cannot be addressed by market-based solutions, or maybe there are other players already working to address this). If so, it will then proceed to the next question in step 2.

STEP 2: Identify and verify market opportunity and need

Once you have prioritised how you want to effect change, you will then need to identify and verify the market opportunity and need. There are guiding questions relating to the various intervention areas, to help you decide which strategy may be the best fit.

+ Case example: A place-based fund in Birmingham, UK

The place-based fund in Birmingham has researched that there are enterprises seeking to increase quality employment for ethnic minority women - ranging from local catering businesses that provide high-quality, flexible employment opportunities to ethnic minority women to accounting B Corps and childcare social enterprises that are owned and led by ethnic minority women. The corresponding EII strategies may include: channel capital to marginalised entrepreneurs, target equality transformative organisations and target ventures with good equality and diversity practices.

STEP 3: Decide on EII strategy/ies

Once you have shortlisted relevant EII strategy/ies, you can then scope the feasibility of these strategies by conducting detailed market assessment. The next section details further how you can conduct market assessment. However, if this is not feasible, you can then return to this diagram again.

+ Case example: A place-based fund in Birmingham, UK

The place-based fund in Birmingham assessed the three relevant EII strategies. From speaking to a handful of a pipeline of ethnic minority women-led social enterprises in Birmingham, the fund realises that they prefer to be self-financed from revenue rather than taking on external social investment - it appears that more time to engage with the community around how and when external investment could be helpful, will be required before embarking directly on this EII strategy. Therefore, the place-based fund decides to focus on equality transformative organisations, especially charities that are spinning off social enterprises to employ ethnic minority women in Birmingham, as well as B Corps that have good equality and diversity practices, such as having a higher than average percentage of their employees who are ethnic minority women.

Assess the market

As part of deciding on and refining your EII strategy, as an investor you will then assess the market in order to find a product-market fit, or to come up with your investment thesis. As with any investment market, for equality impact investing to grow, it requires both demand (from appropriate products/investees) and supply (from investors).

Guiding questions for EII external-facing strategies

Demand from appropriate investees

Are there investable equality impact ventures that are tackling the equality challenges you have identified?

What resources and support do they need?

Can you provide the resources and support they need? Do you already have existing connections with some of these investees?

What is the potential to support the development of appropriate products/investees if they are not yet at an investable stage?

Supply from other investors

Who are the investors with a mission to generate equality impact? What are the equality challenges they focus on?

How much investment do they offer, and through what kinds of investment products?

Are these products well-suited to the needs of equality impact ventures? How can they be further enhanced or developed? Is there a gap you can fill?

Are there opportunities for you to collaborate with other investors?

Wider market trends

What are the wider economic, social, technological and environmental trends that relate to the equality challenges you have identified?

What are the legal frameworks and public policy that compel, incentivise and support the equality challenges you have identified?

Guiding questions for improving investors’ own make up and practices

Practice and composition of your organisation

Has your organisation identified equity, diversity and inclusion to be a strategic issue to address internally? Has this understanding been shared by the leadership (Executive and Board) as well as wider staff team?

Do you have data about your staff makeup, as well as makeup of your portfolio companies and stakeholders? Do you know in which areas you are underperforming?

Do you have in-house expertise to embark on this journey, or have you identified external expertise you can source to support you?

Are there key accountability mechanisms to ensure that progress can be tracked?

Click the icon of the section you’d like to go to